Following an attack aimed at former President Donald Trump, which caused widespread shock in the U.S. political arena, Trump Media (NASDAQ: DJT) saw its shares spike over 60% during early trading on Monday. However, they later retracted by 20%, settling at $36.89 by the close of July 16.

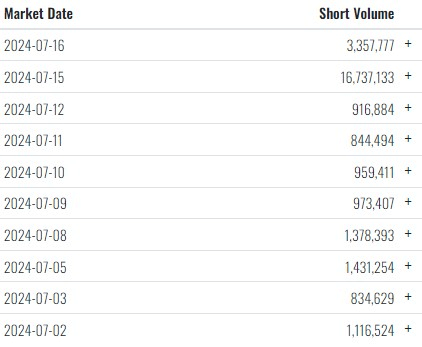

Of note is the doubling of short positions against Truth Social stock between July 1 and July 12, soaring from 7 to 15 million shares. This marked a record level of short interest in DJT stock since its market debut.

This increase suggests that either individuals or large entities were anticipating a significant decline in the stock’s value by July 15, a scenario that could have materialized had President Trump perished during the incident in Pennsylvania.

The potential necessity to offset losses from short positions up to July 12 likely contributed to an additional rise in DJT stock price.

This pattern raises concerns that certain individuals may have possessed prior knowledge of a threat against former President Trump’s life and aimed to capitalize on the anticipated upheaval.

As of now, the short interest in DJT stock has decreased significantly, dropping to 11.27%. Approximately 5,219,586 shares are currently shorted, with an average coverage of less than one day.

A comparable situation occurred on September 11, 2001, where significant bets were placed against the stocks of major airlines, American Airlines (NASDAQ: AAL) and United Airlines (NASDAQ: UAL), the day prior to the attacks.

Later investigations uncovered that a single entity and an insider newsletter had alerted investors, prompting them to make advantageous wagers against the top two U.S. airlines. Consequently, these airlines incurred substantial losses in the aftermath of the hijackings.

Join the Discussion

COMMENTS POLICY: We have no tolerance for messages of violence, racism, vulgarity, obscenity or other such discourteous behavior. Thank you for contributing to a respectful and useful online dialogue.